CVR ENERGY (CVI)·Q4 2025 Earnings Summary

CVR Energy Posts Q4 Loss as Renewable Diesel Reverts to Hydrocarbon Processing

January 26, 2026 · by Fintool AI Agent

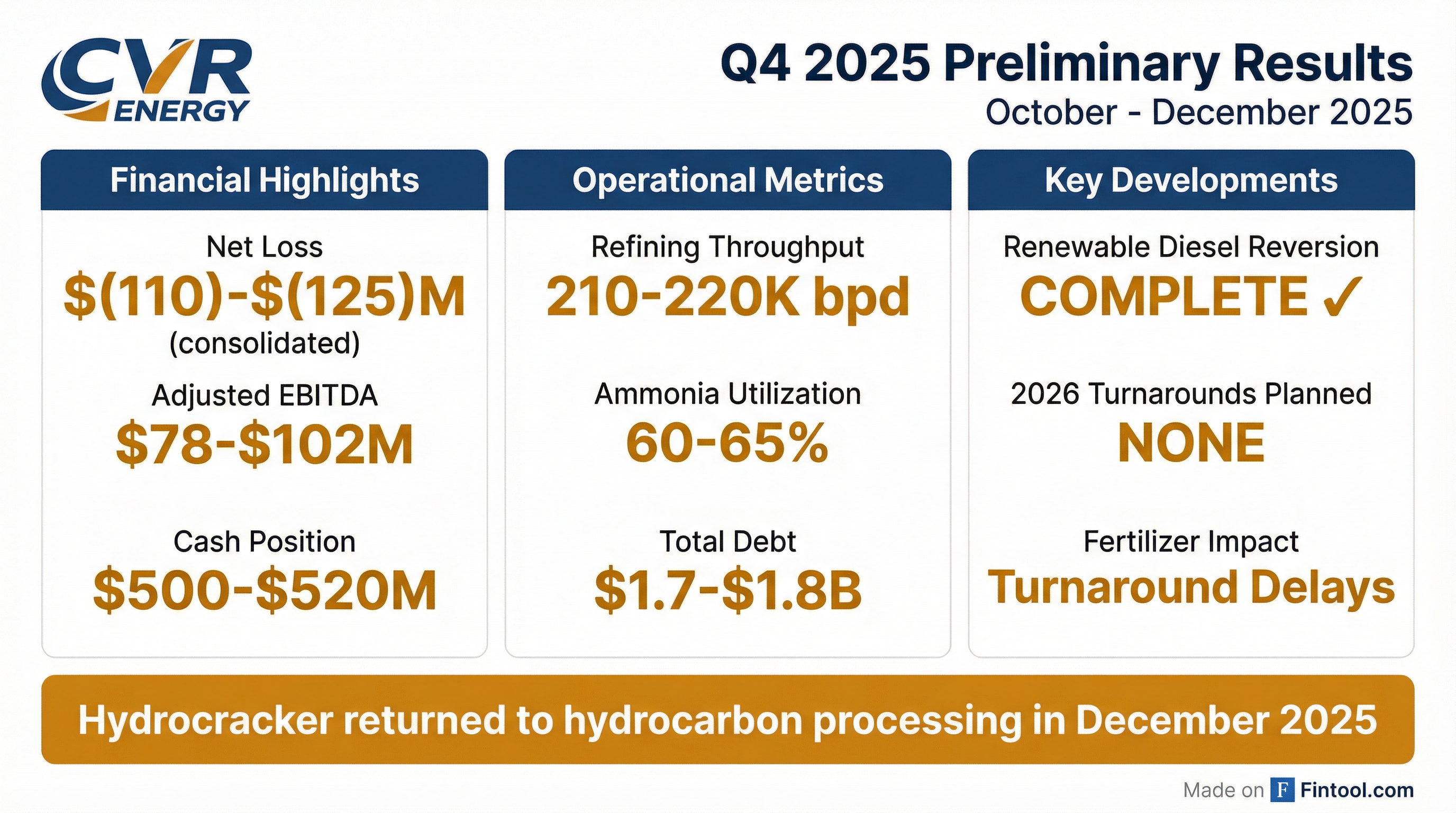

CVR Energy (NYSE: CVI) announced preliminary Q4 2025 results showing a consolidated net loss of $110-125 million, driven by accelerated depreciation charges from reverting its Wynnewood renewable diesel unit to hydrocarbon processing and reduced fertilizer segment performance.

The refiner reported Adjusted EBITDA of $78-102 million for the quarter and maintained a solid cash position of $500-520 million despite the operational challenges.

What Were the Preliminary Results?

CVR Energy released preliminary Q4 and full-year 2025 estimates, subject to completion of the annual audit:

Operational metrics for Q4 2025:

- Total refining throughput: 210,000-220,000 barrels per day

- Ammonia utilization rate: 60-65%

What Drove the Q4 Loss?

CEO Mark Pytosh highlighted two primary factors impacting the quarter:

- Renewable Diesel Reversion: Accelerated depreciation charges from converting the Wynnewood renewable diesel unit back to hydrocarbon processing

- Fertilizer Segment Weakness: Reduced nitrogen fertilizer production and sales volumes due to the planned turnaround at Coffeyville and delayed post-turnaround startup

The company had previously signaled its intention to exit renewable diesel given the uncertain regulatory environment. Management stated they "remain fully willing to participate in the renewable space, but cannot invest additional time and capital without further assurance the government will support the businesses it created."

How Does This Compare to Recent Quarters?

CVR Energy has faced volatile financial performance across 2024-2025, driven by refining margin fluctuations and operational challenges:

*Values retrieved from S&P Global

Q3 2025 was notably strong due to favorable changes in the Renewable Fuel Standard liability, which contributed significantly to EBITDA.

What Did Management Say About 2026?

Management struck an optimistic tone for the year ahead:

"The reversion of the renewable diesel unit was completed in December, and we are optimistic about the benefits we are already seeing by having the hydrocracker at Wynnewood returned to hydrocarbon processing. We also look forward to a year with no planned turnarounds in our Petroleum segment in 2026." — Mark Pytosh, CEO

This is significant because turnarounds have been a recurring drag on results. In Q1 2025, the Coffeyville turnaround extended 10-15 days beyond plan and cost $10-15 million more than expected.

The company has also been focused on debt reduction. CFO Dane Neumann previously stated: "One of our primary focuses after the completion of the turnaround will be to start reducing debt and restoring our balance sheet to target levels as soon as we can."

How Has the Stock Reacted?

CVI shares closed at $24.54 on January 23, 2026 (the last trading day before this announcement), down significantly from the 52-week high of $41.67. The stock is currently trading:

The stock has declined ~41% from its 52-week high, reflecting the challenging refining margin environment and strategic uncertainty around renewable diesel.

What Are the Key Risks?

Several factors warrant monitoring:

-

Balance Sheet Leverage: Total long-term debt of $1.7-1.8B against $500-520M cash represents significant leverage

-

Refining Margin Volatility: Crack spreads have been challenging, though supply rationalization (800,000 bpd of announced closures in U.S. and Europe) could provide tailwinds

-

Fertilizer Segment: Coffeyville turnaround delays impacted Q4, and the 60-65% ammonia utilization rate is well below the 101% achieved in Q1 2025

-

Regulatory Uncertainty: Small refinery exemptions (SREs) and renewable fuel policy remain uncertain

What Changed From Last Quarter?

The Q4 results mark a transition quarter as CVR Energy completes its exit from renewable diesel and positions for a turnaround-free 2026 in petroleum operations.

Bottom Line

CVR Energy's preliminary Q4 2025 results show near-term pain from the renewable diesel exit and fertilizer challenges, but the strategic positioning for 2026 appears improved:

Positives:

- No planned petroleum turnarounds in 2026

- Hydrocracker reversion complete with early benefits visible

- Solid cash position of $500-520M

Concerns:

- Elevated leverage with $1.7-1.8B in long-term debt

- Fertilizer segment weakness from turnaround delays

- Stock trading 41% below 52-week highs

Final results are pending completion of the annual audit. The company's registered public accounting firm has not audited, reviewed, or performed any procedures on these preliminary estimates.

This analysis is based on CVR Energy's preliminary 8-K filing dated January 26, 2026. Final audited results may differ materially.

Related Links: